Getting approved for credit cards in Canada as a student can be tricky. You might just be learning how to maintain your student budget. And with no full-time job and high housing expenses, the student life can be costly.

Best Student Credit Cards for Canadians

- Written by

-

- Jordann Kaye

Why you can trust us

The team at WealthRocket only recommends products and services that we would use ourselves and that we believe will provide value to our readers. However, we advocate for you to continue to do your own research and make educated decisions.

That said, it’s a smart idea to have a credit card as a student because they help you start building credit, make online purchases, and can be a good source of short-term emergency cash.

Fortunately, most financial institutions are sympathetic to the economic hardships of being a student, which is why they created student credit cards, which are designed specifically for students who aren’t able to work full-time while studying. Here are our top picks for the best student credit cards in Canada.

In This Article

- The best credit cards for students in Canada in 2025

- 1. Best overall: Tangerine Money-Back Credit Card

- 2. Best secured card: Neo Secured

- 3. Best cash back credit card: Student BMO CashBack Mastercard

- 4. Best low interest student credit card: HSBC + Rewards Mastercard

- 5. Best prepaid student Mastercard: KOHO

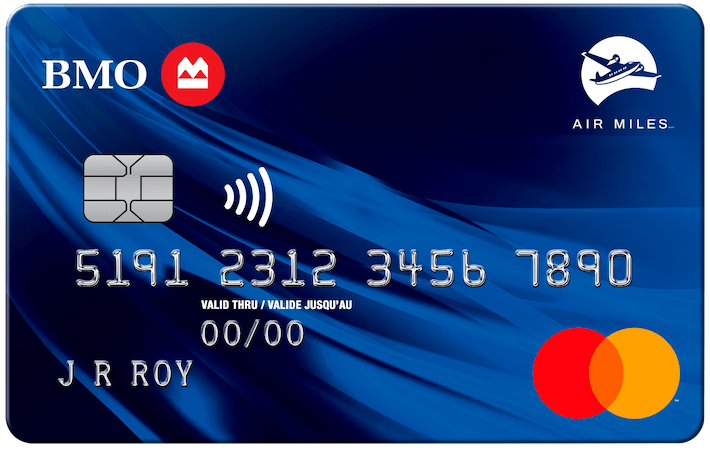

- 6. Best travel rewards Mastercard: Student BMO Air Miles Mastercard

- 7. Best grocery rewards student credit card: PC Financial Mastercard

- How do student credit cards work?

- How to choose a student credit card

- Our final thoughts

The best credit cards for students in Canada in 2025

When used properly, a student credit card can open a world of cashback advantages that can provide a bit of extra wiggle room in for your spending and savings targets.

Here are the best student credit cards in Canada, at a glance.

Tangerine Money-Back Credit Card

Rated 3.7/5 stars.

- Welcome Offer 10% cash back on up to $1,000 in purchases in first 2 months Terms and conditions apply.

- Annual Rewards $282 Learn how we calculate this.

- Annual Fee $0

- Minimum Income Required None

Neo Secured Credit

Rated 2.9/5 stars.

On Neo Financial's Website

- Welcome Offer Earn up to 15% cash back rewards on your first purchase at select partners Terms and conditions apply.

- Annual Rewards $155 Learn how we calculate this.

- Annual Fee $0

- Minimum Income Required None

HSBC +Rewards™ Mastercard®

Rated 3.8/5 stars.

- Welcome Offer None

- Annual Rewards $120 Learn how we calculate this.

- Annual Fee $25 (first year waived*)

- Minimum Income Required None

1. Best overall: Tangerine Money-Back Credit Card

Welcome bonus: 1.95% interest for six months on balances transferred in the first 30 days

- Rewards: 2% cash back in up to three categories of your choice, 0.5% cash back on everything else

- Annual fee: $0

- Interest rate: 19.95%

- Minimum income: $12,000

One of our favorite credit cards for students is the Tangerine Money-Back Credit Card. Although this credit card wasn’t explicitly designed for students, it’s an excellent first credit card, as it has a low minimum income to qualify at just $12,000.

If you maintain a full-time job during the summer and a part-time job while you’re a student, you should be able to qualify. There is no annual fee for this credit card, but you earn rewards if you use it responsibly for your everyday purchases.

With the Tangerine Money-Back Credit Card, you’ll earn 2% cashback rewards in two spending categories of your choice and 0.5% cashback on everything else.

The spending categories to choose from include: groceries, furniture, restaurants, hotel-motel, gas, recurring bill payments, drug store, home improvement, entertainment, and public transportation.

Plus, if you designate your cashback into a Tangerine savings account, you can choose a third spending category to earn 2% rewards.

Tangerine Money-Back Credit Card

Rated 3.7/5 stars.

Rewards

- 2% Earn 2% cash back on certain purchases in your chosen categories.

- 0.5% Earn 0.5% cash back on all other purchases.

- Welcome Offer 10% cash back on up to $1,000 in purchases in first 2 months Terms and conditions apply.

- Annual Rewards $282 Learn how we calculate this.

- Annual Fee $0

- Minimum Income Required None

Pros

- No annual fee

- No limit to the amount of cash back you can collect

- You can choose your cash back categories

- Rewards can be redeemed on credit card balance or deposited to a Tangerine savings account

Cons

- Maximum cash back in any given spending category is 2%

- Not a lot of other card benefits

The Tangerine Money-Back Credit Card is a cash back card that allows you to earn in up to three spending categories, including gas and groceries, restaurants, home improvement, and furniture. Flexibility is key with this card, in that it’s up to you which of the 10 spending categories you get to earn cash back in, and you can change them at any time and they’ll update for the next billing cycle. Cash back can be deposited into a savings account (giving you three spending categories instead of two), or received as a statement credit.

2. Best secured card: Neo Secured

- Rewards: Up to 5% cash back, guaranteed 0.5% cash back

- Annual fee: $0

- Interest rate: N/A

- Minimum income: $0

Although not technically a student card, we love the Neo Secured Credit Card for anyone. The card gives guaranteed approval to anyone who applies. We love this card because it allows people with no or bad credit to enjoy the perks of a credit card at no cost.

The card offers up to 5% cash back on purchases at over 10,000 partnered stores and a guaranteed 0.5% cash back for up to $5,000 spent annually. The welcome bonus offers 15% cash back on a cardholder’s first purchase and a $25 welcome bonus. Cardholders can also choose to add “perks” to their card for added cash back benefits. Perks can be added for a higher cash back rate on 9 different categories: premium access, travel, mind and body, everyday essentials, food and drink, and mobile and personal protections.

When using a secured credit card, you choose the maximum credit limit for your card based on your security funds. This can help students manage their finances without having to borrow money, but still, earn rewards.

Neo Secured Credit

Rated 2.9/5 stars.

On Neo Financial's Website

Rewards

- 15% Earn 15% cash back on first-time purchases at participating partners.

- 5% Earn an average of 5% unlimited cash back at thousands of Neo partners.

- 0.5% Earn 0.5% guaranteed top-up cash back, up to $50.

- Welcome Offer Earn up to 15% cash back rewards on your first purchase at select partners Terms and conditions apply.

- Annual Rewards $155 Learn how we calculate this.

- Annual Fee $0

- Minimum Income Required None

Pros

- Average of 5% cash back, which is a rarity for secured credit cards

- No annual or overdraft fees

- Robust perks program

- Low security deposit requirement ($50)

Cons

- Rewards only available at Neo partners

- Only reports to one of the two credit reporting agencies

The Neo Secured Credit card is best for those who want to improve their credit, but also want to enjoy cash back and other rewards. While most secured credit cards require a hefty security deposit, the Neo Secured card requires just $50. Applicants also won’t get a hard inquiry on their credit report when applying — another plus.

3. Best cash back credit card: Student BMO CashBack Mastercard

- Welcome bonus: 5% cash back on all spending up to $2,500

- Rewards: 3% cashback on groceries, 1% cash back on recurring bills, 0.5% cash back on everything else

- Annual fee: $0

- Interest rate: 19.99%

- Minimum income: $15,000

Possibly the best student card in Canada, the BMO Cashback Mastercard has an excellent welcome bonus.

With this credit card, you’ll earn 5% cashback on all spending, up to a maximum spend limit of $2,500 in the first three months. That welcome bonus is worth up to $125. After that, you’ll earn 3% cashback on groceries, 1% cashback on recurring bills, and 0.5% cashback on everything else.

There is no annual fee to use the BMO CashBack Mastercard, and the minimum income to apply is $15,000, which is accessible for most students.

4. Best low interest student credit card: HSBC + Rewards Mastercard

- Welcome bonus: None

- Rewards: 2 points per $1 spent on dining and entertainment, 1 point per $1 spent on everything else

- Annual fee: $25

- Interest rate: 11.9%

- Minimum Income: $0

Sometimes, as a student, you need to carry a credit card balance. Maybe your student loans haven’t come in yet, or you need to purchase textbooks that were more expensive than expected.

In these cases, carrying these purchases on a credit card could result in hefty interest charges. The HSBC +Rewards Mastercard has a low-interest rate of just 11.9%, which can help keep those interest charges as low as possible.

This credit card is one of the few on this list with an annual fee, but it is low at $25. There is no minimum income to qualify for this credit card, and you’ll also earn rewards points for your spending.

HSBC +Rewards™ Mastercard®

Rated 3.8/5 stars.

Rewards

- 2pts Collect 2 points for every $1 spent on eligible dining and entertainment purchases.

- 1pt Collect 1 point for every $1 spent on all other everyday purchases.

- Welcome Offer None

- Annual Rewards $120 Learn how we calculate this.

- Annual Fee $25 (first year waived*)

- Minimum Income Required None

Pros

- Ultra-low interest rate

- No minimum income level to be approved

- Flexible redemption options for rewards

- Can convert rewards to cash and put toward your HSBC mortgage

Cons

- Annual fee

- Additional cards cost $10 each

- Rewards points vary in value based on redemption categories

The HSBC +Rewards Mastercard is an attractive option for those who want to earn rewards on every purchase, but don’t want to be hit with high interest charges. While it’s never prudent to carry a balance from month to month, if you absolutely have to, the 11.99% interest rate on the HSBC + Rewards Mastercard will take some of the sting out. To have access to this low of a rate for only $25 a year in annual fees is a pretty solid deal.

5. Best prepaid student Mastercard: KOHO

- Rewards: Up to 2% cash back, guaranteed 0.05% cash back

- Annual fee: $0

- Interest rate: N/A

- Minimum income: $0

We love the simplicity of the KOHO Prepaid Card. The card can easily be set up on your mobile device and the user interface is really straightforward. Etrasnfers can be deposited instantly into your KOHO account from your bank account.

Similar to the Neo Secured Credit card, no interest is charged to the account because no funds are being borrowed. You’re only able to spend the amount transferred to the account. This can stop students from overspending while still receiving cash back benefits. There is also a feature that allows you to build your credit, however, this feature is an additional $10/month.

KOHO

- Welcome Offer N/A

- Annual Fee $0 (Easy); $48 (Essential); $108 (Extra); $228 (Everything)

- Regular APR/Interest rates Prepaid

- Recommended Credit 300+

- No minimum credit required

- Fund the prepaid card by adding money from your account (or via direct deposit from a work cheque)

- Earn interest on the balance on your card (from 0.5% to 4%, depending on your plan)

- Earn cash back on purchases (0.25% to 2%, depending on your plan)

6. Best travel rewards Mastercard: Student BMO Air Miles Mastercard

- Welcome bonus: Earn 800 AIR MILES Bonus Miles

- Rewards: Earn 3 AIR MILES for every $25 spent at participating partners, and 1 AIR MILE for every $25 spent everywhere else

- Annual fee: $0

- Interest Rate: 19.99%

- Minimum Income: $15,000

If you’re looking for a rewards credit card that helps you earn AIR MILES, the BMO Air Miles Mastercard for Students is a good place to start.

This credit card has no annual fee and a low-income requirement of $15,000.

When you start using this card, you’ll earn 800 AIR MILES right away, which is worth about $80.

After that, you’ll earn 3 AIR MILES for every $25 spent at approved partners and 1 AIR MILE for every $25 spent elsewhere.

BMO Air Miles Mastercard for Students

- Welcome Offer 300-559

- Annual Fee $0

- Interest Rates 20.99% for purchases and 22.99% for cash advances

- Recommended Credit 300-559

- 3 Miles for every $25 spent at participatingAir Miles partners

- 2 Miles for every $1 spent at eligible grocery stores

- Book flights, hotels, cruises, vacations, and car rentals with points

- Add another cardholder at no extra cost

7. Best grocery rewards student credit card: PC Financial Mastercard

- Rewards: Up to 2% cash back, guaranteed 0.05% cash back

- Annual fee: $0

- Interest rate: N/A

- Minimum income: $0

This card is on our list for the obvious – grocery rewards. And students need to eat. Cardholders will earn 10 Optimum rewards for every purchase at a Loblaws and partnering grocery store, 25 points for every dollar spent at Shoppers Drug Mart, 30 points per liter at Esso locations, 20 points for dollars spent with PC travel, and 10 points for everywhere else.

If your school is located near a Loblaws or partnering grocery stores, this card is kind of a no-brainers. The card gives rewards on all purchases and added rewards for essentials (gas, groceries, toiletries) at PC locations. Many Loblaws locations will also give a 10% discount back to students on Tuesdays. We love how this card rewards purchases that every student will make and has no annual fee.

PC Mastercard

Rated 3.7/5 stars.

- Welcome Offer Up to 20,000 points

- Annual Fee $0

- Interest Rates Purchases: 20.97%, Cash Advances: 22.97%

- Recommended Credit 660 - 724

- No annual fee

- 10 points for every $1 spent at participating grocery stores

- 25 points for every $1 spent at Shoppers Drug Mart

- 30 points for every litre at Esso Mobil

- 20 points for every $1 spent on PC Travel

- 10 points for every $1 spent everywhere else

- 10,000 PC points can be redeemed for $10 at participating stores

- Redeem at 4,500 locations across Canada

How do student credit cards work?

Student credit cards work like any other credit card. However, credit cards for students typically have more incentives and perks geared towards college and university students. These perks can range from lax sign-up requirements to cashback bonuses to rewards or other freebies.

Nevertheless, a credit card and a student card work the same. When using a credit card, the cardholder is borrowing money to make purchases. In some ways, a credit card works a lot like a loan.

Credit card holders who use their credit cards to make purchases have a grace period of 21 days to pay back the money they’ve borrowed. If the payment isn’t made in time or in full, the cardholder will have to pay interest. It can also affect their credit score.

If you choose to use a credit card, try making it a habit to pay your credit card on time. Revolving debt, such as credit card debt, can be a major cause of stress and inhibit you from doing things you’d like to.

How to choose a student credit card

Chances are, you’ve already noticed that there are many, many credit card options available. Whether it’s Visa or Mastercard, or the less common American Express, there seems to be a virtually limitless selection of credit cards to choose from. Student credit cards are no different.

Below, we’ll provide a few things to consider when shopping around for a credit card, whether it’s one for students or one for regular people.

1. Before applying

Before applying for a credit card, make sure that you meet the eligibility requirements. When applying for a credit card, a credit inquiry is made. If you do not qualify for the card, the credit check may negatively impact your score.

Some eligibility requirements include a minimum yearly income or minimum credit score, among others.

2. Consider fees and annual percentage rates (APR)

Some credit cards come with an annual fee, while others do not. An annual fee is a fee charged by the credit card company each year. Typically, an annual fee on a credit card means more perks come with the card, but this is not always the case.

If you choose a credit card with an annual fee, make sure that the annual fee is worth the amount that it’s used.

3. Cash back vs. rewards

Credit cards tend to offer either cashback or rewards.

- Cashback offers a percentage of cash per purchase

- Rewards are offered by the credit card provider which can be used towards rewards, including travel, groceries, and more

Consider which you would prefer between the two. Cashback is more flexible and can be spent on anything, but rewards typically help you remain focused on specific rewards.

4. Use your credit card wisely

Of course, responsibly using your credit card is a major component of owning a credit card. A few tips for using your credit card wisely include:

- Paying your bill off on time

- Keeping your balance below one-third of your total limit, also known as a low utilization ratio

- Understand how your card works

- Avoid cash advances

Our final thoughts

A student credit card can be an excellent resource when it comes to building credit and purchasing necessities. That said, it can equally cause many financial issues.

Be sure to use a credit card wisely if you decide to get one, and be sure to pay it off in time, spend it within your means, and use it only when necessary.

Jordann Kaye

Jordann Kaye is a content marketing manager and spokesperson at Zolo Canada and freelance financial writer based in Halifax with more than 10 years’ experience. She writes about personal finance topics, such as investing, insurance, credit cards, and real estate.

Frequently asked questions

One of the best ways to build credit is to have multiple credit types and make your monthly payments on those credit types faithfully.

If you’re a student, you may already have student loans, but a credit card will help you diversify your credit types. It’s crucial to make your monthly payments on time. Otherwise, a credit card will do more harm to your credit score than good.

A credit card can be a useful tool for a student. You may need to make online purchases, such as booking flights home to visit family, which you can’t do with a debit card.

Credit cards also make a good source of short-term emergency cash. If you live on your own for the first time and need access to money quickly, a credit card can be an excellent first line of defense and even tide you over while you access the funds to cover the emergency.

If you’re a graduate student looking for a credit card, then the Tangerine Money-Back Card is a good choice for you.

This no annual fee credit card encourages saving money. Once you graduate and begin full-time employment, you can easily convert the card to the Tangerine World Mastercard, which offers even greater rewards for the same $0 annual fee.