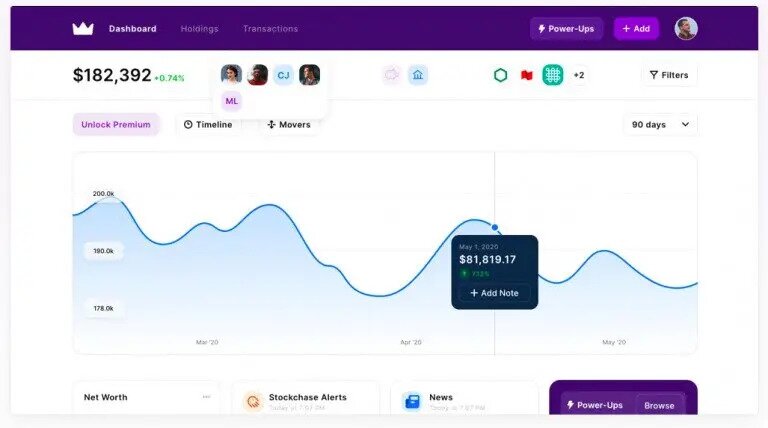

When it comes to personal finances, keeping track of your net worth is a must. However, with multiple financial institutions and investment portfolios, it’s not always easy. The last thing anyone wants to do is spend hours building a fancy Excel spreadsheet trying to navigate your way through the cells and formulas. That’s why most investors opt to have an investment dashboard that consolidates all their assets in one place. Wealthica’s investment tracking app will give you a snapshot of your net worth and show you how your portfolios are performing with the click of a button.

In this Wealthica review, we will dive into what Wealthica is all about, how it works, and highlight some notable features to help simplify your financial life.