Product Rating Methodology

Here at WealthRocket, our main focus is to help you get the most out of your money. One of the ways we do that is by rating and reviewing a wide variety of financial products so you can make money decisions with confidence.

Our team of writers and editors regularly review a variety of financial products and companies, including credit cards, bank accounts, tax filing software, budgeting apps, insurance providers, mortgage lenders, crypto exchanges, and so on. They dive deep into every aspect of the product/provider, offering honest and accurate information about features, including fees, perks, pros and cons, as well as any other information we think you should know about.

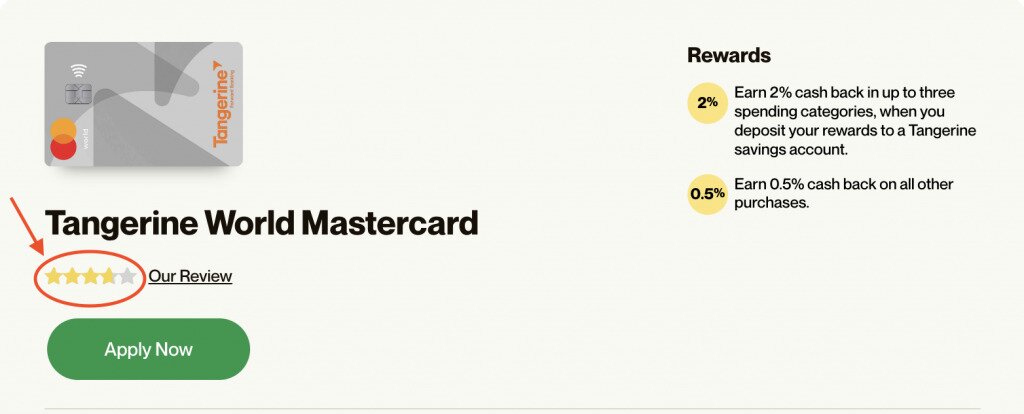

We feed that information into a spreadsheet that features a weighting algorithm, which gives each product a star rating on a scale of 0 to 5 — 0 stars being the worst rating a product can get, and 5 stars being a perfect rating. We use tenths to provide an even more specific rating, which is why you’ll see stars partially filled in sometimes. This demonstrates ratings like 4.6, 3.3, and so on. A star rating is never determined by WealthRocket’s affiliate relationships — only by the features evaluated. We pride ourselves on maintaining this editorial independence from our affiliate partners.

You’ll find the star rating in the lefthand corner of the callout box on our review pages. See below for a credit card rating example:

Credit Card Review Methodology

Spending scale

We begin by evaluating each credit card based on a monthly spending scale of $2,000. We adjust this figure according to the card’s primary category for a realistic representation of typical monthly spending.

When calculating a card’s annual rewards value, or first-year value, we base it off a monthly spend of $2,000, which is spread across each of the following categories:

- Transit

- Gas

- Groceries

- Dining out

- Travel

- Bills

- Drug stores

- Entertainment

- Any other categories that some credit cards may offer

Features analysis

We then examine the myriad features each credit card offers (around 100 in total) to ensure a holistic review. Those features include:

- Eligibility requirements (credit score, income, annual spend)

- Interest rate

- Annual fee

- Foreign transaction/exchange (FX) fees

- Balance transfer fee

- Cash advance fee

- Welcome offer and promotions (how much you have to spend vs. how much you get and the ratio between the two)

- Annual rewards/earn rate compared to other cards (how much could you earn in rewards, in dollars, per year?)

- Insurance (travel, rental car/collision, warranty and purchase protection, mobile device protection, etc.)

- Perks (including travel perks, exclusive ticket access, etc.)

Because all credit cards aren’t created equal, we adjust the weight of each feature according to the card’s primary category.

For example, when rating travel credit cards, we assign a higher weighting to the rewards category than we do the interest rate category, since users are probably searching for a travel credit card for the points and not necessarily a low interest rate.

User-centric analysis

When conducting reviews, we work to understand the target audience of each credit card. We ensure our reviews reflect the needs, wants, and preferences of the potential card users (e.g. frequent travellers), rather than a general audience.

Diverse category analysis

We organize each of our credit card reviews into four major categories:

-

- Rewards

- Eligibility

- Interest rates and fees

- Perks

Here are some examples for how we delve deeper by card type:

- Travel credit cards

-

- Assess the balance between fees and benefits

- Delve deep into rewards and travel insurance

- Rewards credit cards

-

- Assess the overall annual dollar value users get for their spending

- Ensure rewards offer good value when balanced against any applicable fees

- No-fee credit cards

-

- Focus on the rewards and any other benefits provided

- Determine whether the card still provides a decent value with no fees

We’re committed to bringing you the most current welcome offers and interest rates. So when we get word from our credit card partners about any relevant changes, we update our content to reflect this so that you are reading the most up-to-date information available.

Banking Review Methodology

When evaluating banks and credit unions, we examine/identify the following categories:

Interest rates and returns

- Compare interest rates across all banks and credit unions, with a particular focus on savings rates

- Analyze the stock price of each bank or credit union (i.e. how stable has it been?), as well as how it’s generating profits

Fees and minimum balances

- Review each bank’s fee structure and disclosures for clarity and transparency; flag any hidden charges.

- Examine each bank or credit union’s monthly banking fee (if applicable) to those of competitors

- Review any minimum balance requirements for various accounts (how prohibitive are they?)

User experience

- Test online and mobile banking platforms for ease of use and functionality.

- Add in our personal past experiences with banks and credit unions

Customer service

- Review J.D. Power satisfaction ratings of each bank and credit union

- Examine online discussions and forums (e.g. reddit and Trustpilot) to gather feedback on customer service experiences, including call wait times, online chat response times, and whether there’s 24-hour support available, etc.

- Integrate insights from our own customer service experiences with each bank or credit union.

Security and insurance

- Review each bank or credit union’s online and offline security protocols and measures

- Check for any current or historical public announcements of failed security issues

- Verify whether the bank or union is a CDIC member

Accessibility

- Map out the physical branch and ATM networks of each bank or credit union.

- Assess geographical coverage and convenience factors.

- Does the bank or credit union offer mobile banking? If so, how does the app stack up against competitors?

Services and features

- The number of services each bank or credit union provides.

- Any unique offerings that set a bank or credit union apart from its competitors.

- Value-added services and benefits provided by each bank or credit union.

- Depth and quality of any financial literacy resources the bank or credit union provides (e.g. credit building or budgeting tools)

Investing Review Methodology

When evaluating investing apps and platforms, we look at the following categories:

Fee structure

- How does the app/platform charge for trades? In other words, what commission does it take?

- Identify any mandatory recurring charges, such as account inactivity or annual fees, and find out if/how they can be waived.

- See if there are fees for less common services that may impact active or specialized traders, such as margin rates.

Withdrawal and deposit methods

- Identify and list the methods available for moving money into and out of the platform

- Evaluate the expected timeframe for completing these transactions, noting any platforms that facilitate quicker access to funds.

Investment options

- Detail the available investment options and indicate the markets where these can be traded.

- Evaluate the extent of market access, focusing on major exchanges and any international trading capabilities.

Features and usability

- Rate the platform’s ease of use and the utility of its trading tools.

- Evaluate the functionality and design of the mobile app, its trading capabilities, and how it compares to the desktop experience.

- Describe the various account types offered and explore any specialty products that could appeal to niche investors.

Customer service and support

- Detail the availability and accessibility of customer service channels.

- Assess the responsiveness and effectiveness of the app/platform’s customer support team by simulating customer inquiries and gathering user feedback from platforms such as reddit and other public forums.

Regulatory compliance and security

- Analyze the security measures in place to protect users’ data and funds, including whether the app/platform is a member of the Canadian Investment Protector Fund (CIPF).

Bonuses and promotions

- Detail the terms and true value of any sign-up bonuses or promotions.

Integration with other financial services

- Evaluate how seamlessly the investing app/platform integrates with other financial services offered by the same entity.

- Look for and rate the ease with which the app/platform can be used alongside third-party external financial tools and services.