Making sense of the changing economy post-COVID-19

- Written by

-

![A headshot of Rachel Cribby who is a contributing author at WealthRocket]()

- Rachel Cribby

- Edited by

-

- Zack Fenech

Why you can trust us

The team at WealthRocket only recommends products and services that we would use ourselves and that we believe will provide value to our readers. However, we advocate for you to continue to do your own research and make educated decisions.

Since the start of the Covid-19 pandemic, things haven’t really been business as usual for the Canadian economy. Okay, so they haven’t been “business as usual” for anyone, anywhere, but there’s no denying that the ebb and flows of the economy have a cascading effect on everyone in the country.

So how can we make sense of the changing economy around us? Luckily, there’s no shortage of statistics and insights to analyze. Here’s a round-up of the ones we find the most telling.

In This Article

- Impact of the pandemic on small businesses

- Culture and the arts have seen a profound impact

- Travel and tourism is on the rebound

- Some spending habits from the Covid economy are here to stay

- Housing affordability at 31-year low

- The cost of pretty much everything has increased (but not so much wages)

- Overall economic performance has exceeded expectations

Impact of the pandemic on small businesses

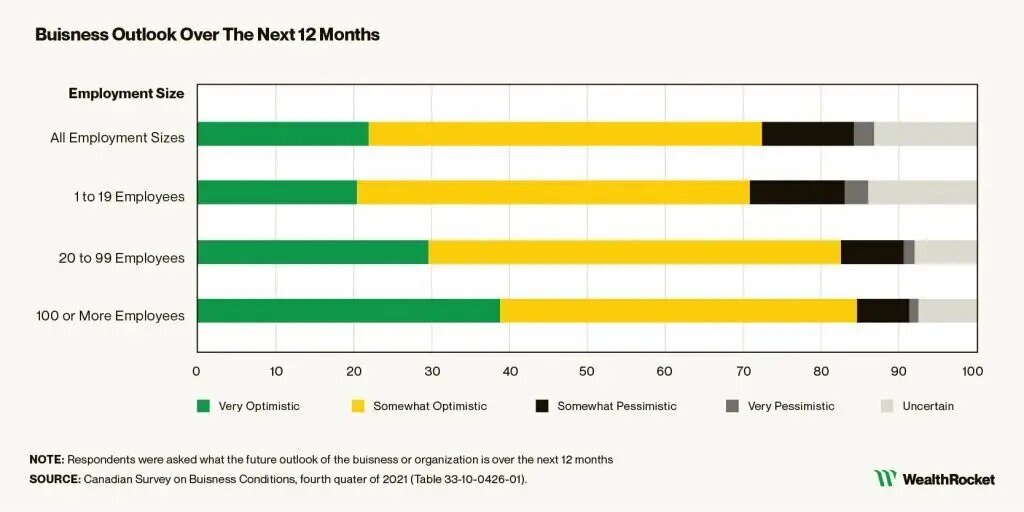

The Covid-19 pandemic has had the largest impact on small (and medium) sized businesses. As per Stats Canada, the main reasons for this is that businesses of this side are more likely to be involved in the tourism industry, which was among the country’s most hard-hit industries. Small companies have 99 employees or fewer.

Not only were small businesses more prone to loss of sales, but they are also less likely to forecast future increases in sales. This also means that they are predicting a more difficult time repaying applicable government loans and Covid recovery programs.

Source: Statistics Canada

Culture and the arts have seen a profound impact

Though deeply affected, travel and tourism wasn’t the only industry to see its very fabric shaken to the core. The effects have also resulted in many changes for the arts, culture, and recreation sectors in the country. This includes entities like publishing companies, recording studios, movie sets, performing arts venues, sporting activities, amusement parks, etc.

Obviously, many of the aforementioned activities require large crowds in order to remain profitable and are incongruous with a remote set-up. Many of these events were also highly vulnerable to last-minute cancellations and can’t sustain high levels of buyer confidence.

Travel and tourism is on the rebound

We would be remiss to talk about the changing economy without shedding some light on the travel and tourism sector. The good news for the tourism industry is that Canadians are starting to slowly but surely match 2019 levels of travel-related spending. Canada recently welcomed one million visitors in one week for the first time at the start of the pandemic. The Government of Canada only dropped testing requirements for fully-vaccinated travellers as of April 1, 2022, so the upward movement of the tourism industry still remains to be seen.

Obviously, many of the aforementioned activities require large crowds in order to remain profitable and are incongruous with a remote set-up. Many of these events were also highly vulnerable to last-minute cancellations and can’t sustain high levels of buyer confidence.

Some spending habits from the Covid economy are here to stay

Remember the days when toilet paper was rarely spotted in the wild and it seemed like everyone that you knew was buying a home exercise bike? Those days may be a thing of the past, but it turns out that those spending decisions are not just a punchline to a joke. They’ve also fundamentally shaped the consumer habits of Canadians.

For one thing, those at-home gym purchases? Experts say that they’re likely here to stay, thanks to convenience and an increase in home offices. Auto-replenishing subscription services are another buying habit that accelerated during the pandemic and seems to be here to stay.

And it’s not just a matter of product choice, either. It’s possible that going through a pandemic together has awoken a sense of altruism in some of us. In one survey from EY Canada, 69% of participants said that they will be more inclined to purchase from a brand that is making positive change within the world, something that brands will have to be aware of as they prepare for the changing economy.

Housing affordability at 31-year low

It’ll come to no surprise to anyone that housing prices across Canada have seen double-digit increases since the start of the pandemic. This might just be the part of the changing economy that the most Canadians experience firsthand.

It’s at the point now that first-time homebuyers are responsible for fewer and fewer home purchases, with investors and second (or third) time homebuyers accounting for a larger proportion of homebuyers. Since the pandemic’s start, investors have seen by far the largest income gains from home investments. The presence of investor further drives the competitive nature of the market.

Source: Bank of Canada

The cost of pretty much everything has increased (but not so much wages)

As consumer habits shift, some experts predict that they will not only continue to shift but will continue to slow down. The reason? Consumer inflation is at a three-decade high as of May 2022. Stats Canada reports that consumer inflation is currently 7.7% across the board. For grocery prices, the actual rate is even higher—around 9.7%.

Wages, on the other hand, have only risen between 2.4 to 2.7%, so it would make sense to see Canadians holding on a bit tighter to their dwindling spare change. Among the reasons for the high inflation rate are supply chain disruptions, greater demand for products, widespread drought, and geopolitical conflict.

A report by Stats Canada found that, “nearly three in four Canadians reported that rising prices are affecting their ability to meet day-to-day expenses such as transportation, housing, food, and clothing. As a result, many Canadians are adjusting their behaviour to adapt to this new reality, including adjusting their spending habits and delaying the purchase of a home or moving to a new rental”.

*Updated June 2022

Overall economic performance has exceeded expectations

Though the above offers plenty to worry about, it’s important to keep the big picture in mind. Overall, the Canadian economy is recovering faster than was anticipated. In fact, the economy technically returned to levels of pre-pandemic activity in the final quarter of 2021. This is the fastest recovery of the last three recessions that we’ve gone through as a country (the other two most recent recessions being 1990-1992 and 2008-2009).

The availability of government support and initiatives has been largely credited with the resiliency of businesses that were so deeply affected by the Covid-19 pandemic. However, inflation is still keeping consumer levels relatively at bay, and questions of how to fix the affordability crisis remain unanswered, even if the trajectory of economic change has become more clear.

Rachel Cribby

Rachel Cribby is a professional writer, editor, and transcriptionist from Canada. Her personal finance work has been published in Greedy Rates and Forbes Advisor.